Taxes

Table of Contents

Manage Tax Invoice preferences (Taiwan)

Learn how to set up your preferred settings for Tax Invoice on the Merchant Portal and Eats365 POS.

In this article, you’ll learn how to set a default tax type for your restaurant and set specific tax types to menu Items, generate Invoice Numbers, and configure a printer to print tax invoices.

Tax types

Set your restaurant’s default tax type, or set an Item’s tax type if they’re an exception to the restaurant’s default tax type. These tax types include Taxable (TX) and Tax Free (TF). To learn about these tax types, refer to Taiwan’s taxation policies.

Restaurant Tax type

To set your whole restaurant’s default tax type, follow the steps below:

- Log in to Merchant Portal.

- On the left panel, click on Restaurant Settings.

- Select Basic Information, then Restaurant Information.

- Under "Tax Type," click on the drop-down arrow and select the applicable Default Tax Type.

- Click on Save to confirm.

Item Tax type

If an Item is an exception to the default tax type that you’ve set for the whole restaurant, you can set the Tax Invoice type that’s specific to the Item.

To specify an Item’s Tax Invoice type, follow the steps below:

Eats365 POS

- Log in to the Eats365 POS.

- At the top left, tap Settings

.

. - Under "General," tap Menu Setup, then select Item.

- Select the Item that you’d like to set the Tax Invoice type for.

- Next to "Item Tax Type," click on the drop-down arrow and select the applicable Item Tax Type.

- At the top right, tap Save.

Merchant Portal (Classic Theme)

- Log in to Merchant Portal.

- On the left panel, click on Menu Setup, then Item.

- Select the Item you’d like to set the Tax Invoice type for.

- Next to "Item Tax Type," click on the drop-down and select the applicable Item Tax Type.

- Once done, scroll to the top and click on Save at the top right.

Merchant Portal 2.0

- Log in to Merchant Portal.

- On the left panel, click on Menu Setup, then Item.

- Select the Item you’d like to set the Tax Invoice type for.

- Next to "Item Tax Type," click on the drop-down and select the applicable Item Tax Type.

- Once done, scroll to the top and click on Save at the top right.

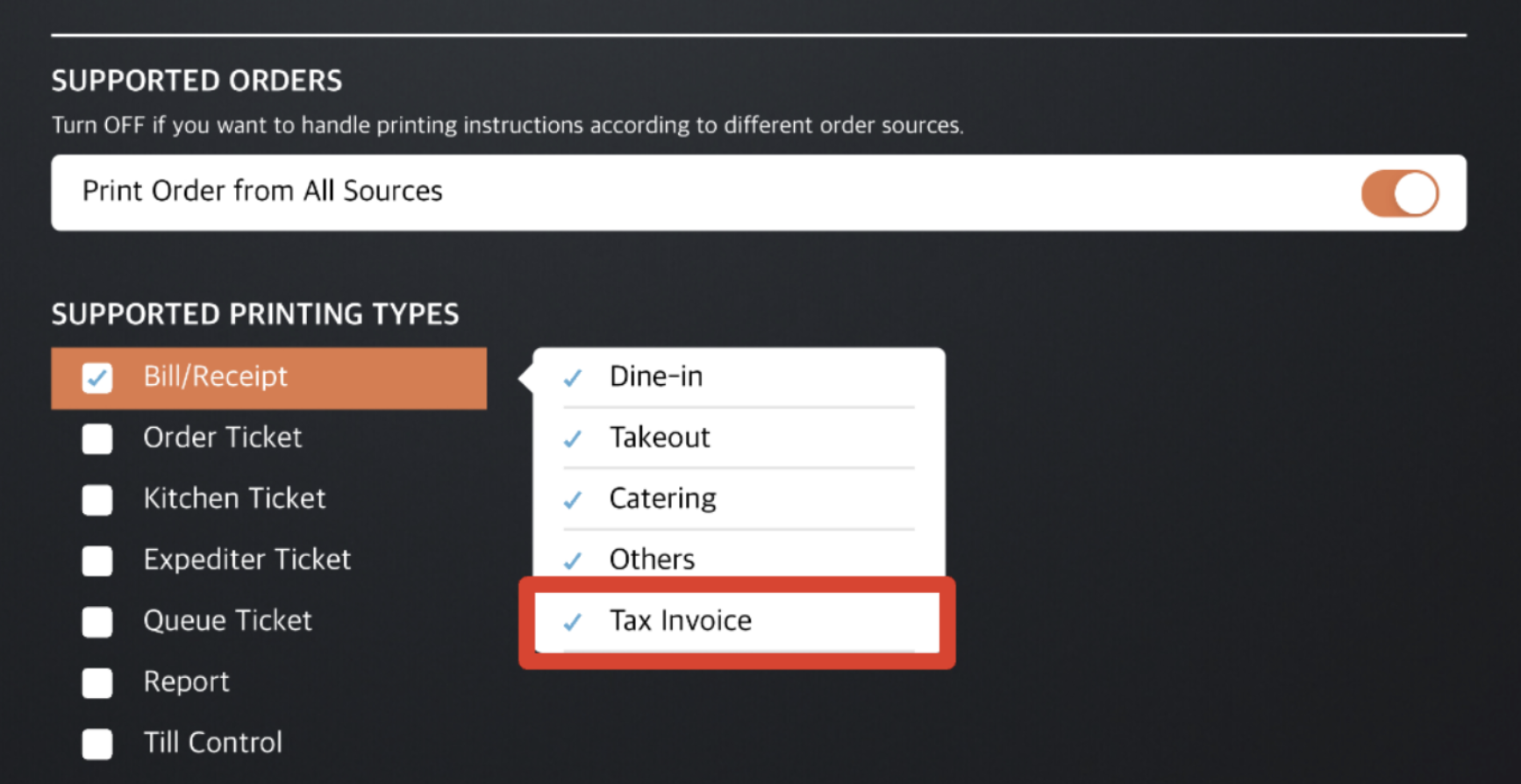

Set a printer to print Tax Invoice

To configure a printer to print Tax Invoice, follow the steps below:

- Log in to the Eats365 POS.

- At the top left, tap Settings

.

. - Under "General," tap Printer Setup, then choose a connected printer.

- Set the Printer Paper Width to 58mm.

- Under "Supported Printing Types," place a check mark beside "Bill/Receipt," then select Tax Invoice.

- At the top right, tap Save to confirm.

Disable Tax Invoice issuing for select POS terminals

If you have multiple Eats365 POS terminals, you can turn off the ability to issue Tax Invoices on certain terminals. To do this, follow the steps below:

- Log in to the Eats365 POS.

- At the top left, tap Settings

.

. - Under “Settings,” tap e-Invoice.

- Under “Invoice General Setting,” turn on Suspend Invoice Module

. This disables the Tax Invoice function on the POS.

. This disables the Tax Invoice function on the POS.

Eats365 Products

Eats365 Products Merchant Guide

Merchant Guide Modules

Modules Membership

Membership Integrations

Integrations Hardware

Hardware Staff Operations

Staff Operations Roles & Permissions

Roles & Permissions Payments

Payments Reports

Reports What’s New

What’s New Release Notes

Release Notes Troubleshooting

Troubleshooting Simulators

Simulators Glossary

Glossary Troubleshooter

Troubleshooter System Status

System Status